Appreciated Securities

A mutually beneficial way to support our special work.

Securities and mutual funds that have increased in value and been held for more than one year are one of the most popular assets to use when making a gift to Everstand. Making a gift of securities or mutual funds to us offers you the chance to support our work while realizing important benefits for yourself.

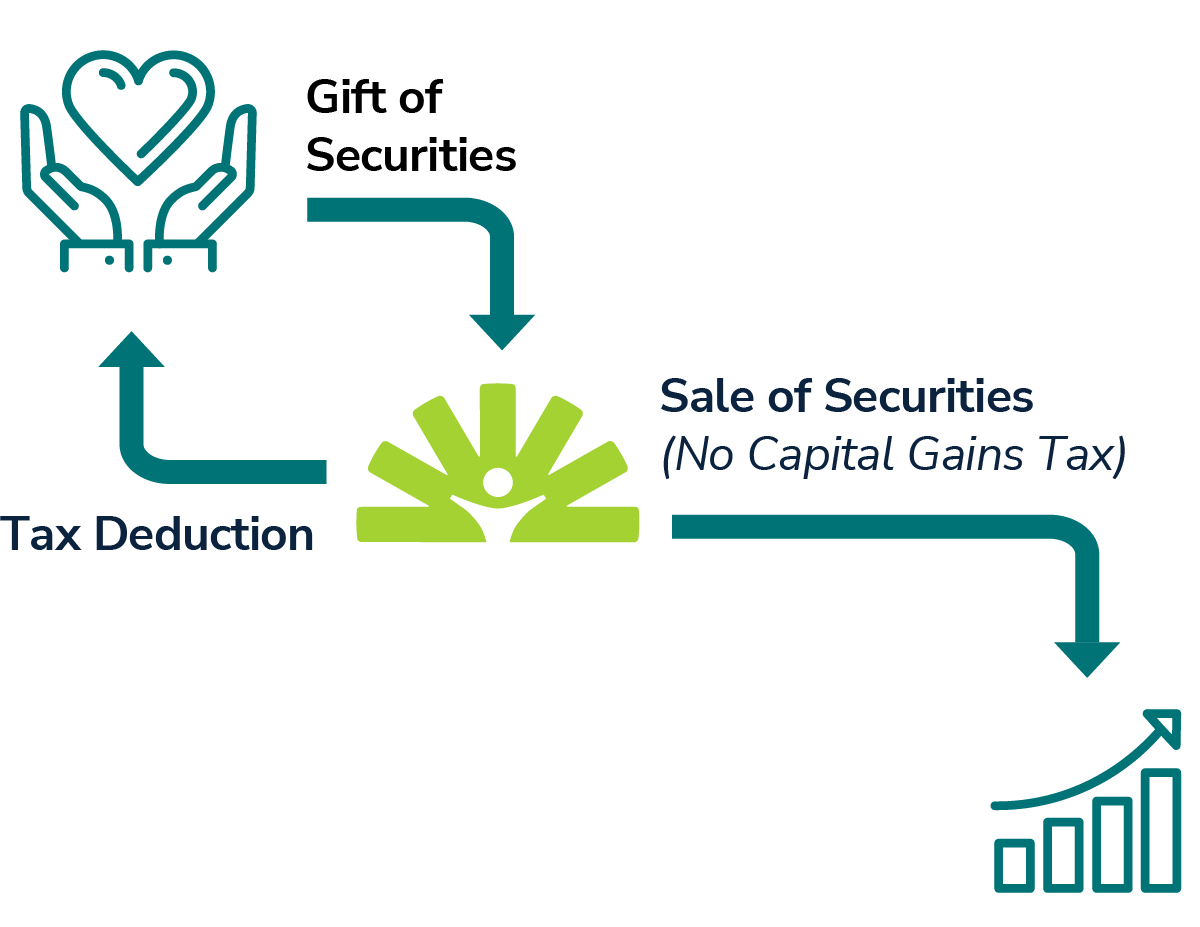

When you donate appreciated securities or mutual funds you have held for more than one year in support of our mission, you can reduce or even eliminate federal capital gains taxes on the transfer. You may also be entitled to a federal income tax charitable deduction based on the fair market value of the securities at the time of the transfer.

How it Works

You transfer appreciated stocks, bonds, or mutual fund shares you have owned for more than one year to Everstand. Everstand sells the securities and uses the proceeds in support of our mission.

Benefits

You receive an immediate income tax deduction for the fair market value of the securities on the date of transfer (even if you originally paid much less for them). You pay no capital gains tax on the transfer when the stock is sold. Giving appreciated stock can be more beneficial than giving cash. The “cost” of your gift is often less than the deduction you gain by making it.

Instructions

If you would like to make a gift of eligible securities, please follow these instructions:

Forward your broker a letter of instruction, including the specific name and number of the securities you are giving, requesting that the securities be transferred via DTC to:

Bank of America

DTC #: 0955

Account Name: Board of Child Care (dba Everstand)

Account #: 45200257411226

Email a copy of your letter of instruction to:

Caitlin Christ

Senior Director of Marketing and Development

Email: cchrist@everstand.org

If you have questions, you can reach out to our Investment Advisor:

Megan Brune

Brown Advisory

Phone: 410-537-5308

Email: mbrune@brownadvisory.com

Need assistance?

To speak with a member of the Everstand Development team, please click here to send an email or call 410-922-2100.